Qyu Technologies CTA

Foreign exchange experts

specializing in geoeconomic analysis and technical trading strategies covering the major world currencies.

specializing in geoeconomic analysis and technical trading strategies covering the major world currencies.

At Qyu, we use “geoeconomic” analysis to determine what strategies or actions a state might pursue in the international political economy to help our clients benefit from the changes.

The Forex (foreign exchange) market is the largest financial market in the world, and the sheer size of the Forex market sets it apart from all other markets. The Forex market is estimated to have a daily trading volume of $4 Trillion USD, with most of the trading activity concentrated on a few major currency pairs. This dwarfs the dollar-per-dollar trading volume of all of the world’s stock markets combined, for which the average daily trading volume is only about $84 Billion USD.

Targeting the world’s most-traded currencies, in the world’s most-traded market, provides Qyu Tech with the benefits of trading in a market that has extremely high liquidity, making it easy to seamlessly move into and out of positions without worrying about whether a buy or sell order can be filled quickly. Qyu Tech strength in trading, or Qyu Tech's “Edge”, is built on our exceptional understanding and analysis of the nuances of the US economy and our expert skill in dealing with financial markets. Since the US Dollar is the world’s official reserve currency, and all the world’s central banks keep the US Dollar on their books, our keen sense of the fundamental trading action and price movement of the US Dollar against the other major currencies is central to our trading operation’s success.

If you asked me to distill trading down into its simplest form, I would say that it is a pattern recognition numbers game. We use market analysis to identify the patterns, define the risk, and determine when to take profits.

- Mark Douglas, Trading in The Zone

The majority of our trade entries involve pairing the US Dollar with one of the other seven major currencies. This trade pairing strategy is based on the following facts about Qyu and the markets in which Qyu trades.

allows us to seamlessly move into and out of positions.

incurred when trading the US Dollar due to the bid-ask spreads being the least expensive in the foreign exchange markets.

of the US Dollar and the role it plays in the financial markets and the world economy.

in trading the Forex markets based on our proprietary modeling of the markets’ behavior.

Since the relative businesses and governments of the eight major currencies participate in trading commodities such as natural resources, manufactured goods and other valuables between each other, they must also exchange each other’s currencies in order to buy or sell those commodities. As the supply and demand for the commodities fluctuate, so do their prices. As the prices for the commodities fluctuate, buying or selling a commodity from a country can require more or less of that country’s currency, thus also driving the supply and demand for that country’s currency.

For some of the pairs we trade, the price is primarily driven by the relative economic health of the two countries involved, and not so much by the changing supply and demand for commodities. All countries construct and refine their fiscal policies in order to manage the health of their economies. In order for each country to promote its own economy’s health, they must keep a sharp eye on the fiscal decisions and economic behavior of the other countries so that they may react in a manner most beneficial to their own economy. For these countries, we observe how they react to each other in order to analyze the market behavior of their currencies. Of our seven currency pairs, the four pairs whose prices are primarily driven by economic relationships are:

For these three currency pairs, the price is primarily driven by the supply and demand for commodities. This is due to Australia, New Zealand, and Canada being major commodity-producing countries. For this reason, they are greatly affected when the world economies slow down, and they are devastated during global recessions . While we do not trade the currencies of Emerging Markets, these three currency pairs give us an understanding of the health of EM currencies because when these three commodity-driven economies slow down we know that the affect is severely worse for the economies in Emerging Markets.

Almost all of the world’s countries, even those whose currencies we don’t trade, are significantly dependent upon the US Dollar. That’s not just because it’s the official reserve currency of the world, but also because they must exchange their currency into US Dollars in order to purchase crude oil. The commonly used term “Petro-Dollar” encapsulates this significance. For example, Canada is a major oil producing nation and when we organize our trading models for crude oil valuation to the US Dollar the Canadian Dollar is usually involved. However there are many other currencies whose currencies are heavily influenced by oil prices or other commodities and we continuously study them, but we don't currently trade them because their currencies aren't as well-developed. They may not have a good practice of publishing economic reports, might have unpredictable leaders or frequent regime changes, ongoing civil wars, or other obstacles that introduce variables difficult to include in our probabilistic models. The most important variable necessary for a currency pair to be included in our models is for sufficient liquidity. Without high levels of liquidity, risk cannot be reliably controlled.

The average person does not understand the great influence that trade agreements have on the world’s countries because only an elite few benefit directly from those trade relationships. Those elite few may argue that the masses also gain a benefit from these agreements, but those benefits are only through ancillary effects.

Part of our success in the foreign exchange markets comes from our ability to understand and analyze all of these economic components and relationships. The other part of our success comes from our trading skill which is based on our expert understanding of market behavior.

For select clients, Qyu Technologies Corporation (“Qyu Tech”) offers a direct-to-account trading service. With this service, Qyu Tech’s trades are executed directly in the brokerage account of the client, providing the client with full transparency into their account’s activity. Qyu Tech’s performance fees are invoiced to the client quarterly.

Qyu Tech coordinates with two top brokerage firms to offer this service. These firms were elected based on in-depth research and trials of their trade software, and Qyu Tech believes they are amongst the most professional brokerages in the market today. This cautious approach is necessary as brokerages in foreign exchange are not as heavily regulated as those in the US stock or commodity markets. There is no central government or regulatory body which requires foreign exchange brokerages to adhere to high standards of business conduct. Qyu Tech chose these two brokerage houses because of the steady reputation they have exhibited in our extensive business dealings with them to date. They provide a solid trading platform, with respectable price continuity, minimal slippage allowances and a willingness to support our CTA arrangements, all important factors in choosing a brokerage partner for our clients.

Qyu Tech introduces the client to the selected brokerage firm based on the client's specific requirements, after which the client deals directly with the firm to complete the account creation and standard KYC/AML processes. The client then enters into a binding CTA Service Agreement with Qyu Tech, hiring and authorizing the company to provide CTA services for the client’s brokerage account. Qyu Tech executes trades on behalf of the client according to this agreement using tools available on the Meta Trader 4 (MT4) platform.

Unrestricted real-time access to trade activity

No waiting for statement distributions

No subscriptions or lock-in periods

Maintain direct control of your capital

Quarterly high-watermark

30% performance-based incentive fee

No management fees

White-label friendly

Added fund/portfolio diversification

Tailored risk profiles

The following are in-house projects, all still under development.

Our commodities desk adds additional diversification to our portfolio. Our experienced traders and analysts draw from their breadth of fundamental knowledge about the global supply chain and combine that knowledge with powerful technical analysis techniques and forecasting technology to find value within the market. Our trades generally are short to mid-term in length and aim to capture large movements in price activity. A majority of our trades consist of both options trades and futures spreads.

The crypto-currency market is expanding very rapidly and we are well-positioned to increase returns to your portfolio through this alternative investment vehicle. We have been engaged in the crypto-currency arena for over 3 years as both miners and traders. Due to the explosion of different types of coins and tokens in the marketplace as well as the increase in marketplaces Qyu Tech is developing a model utilizing margin trading, spot trading, and dollar cost averaging.

Much of our success in the crypto-currency arena builds upon our expertise in the forex market and experience working in the crypto arena. The trades we make are based upon strong technical analysis indicators as well as forecasting algorithms based upon previous price movements in relation to co-related currency pairs.

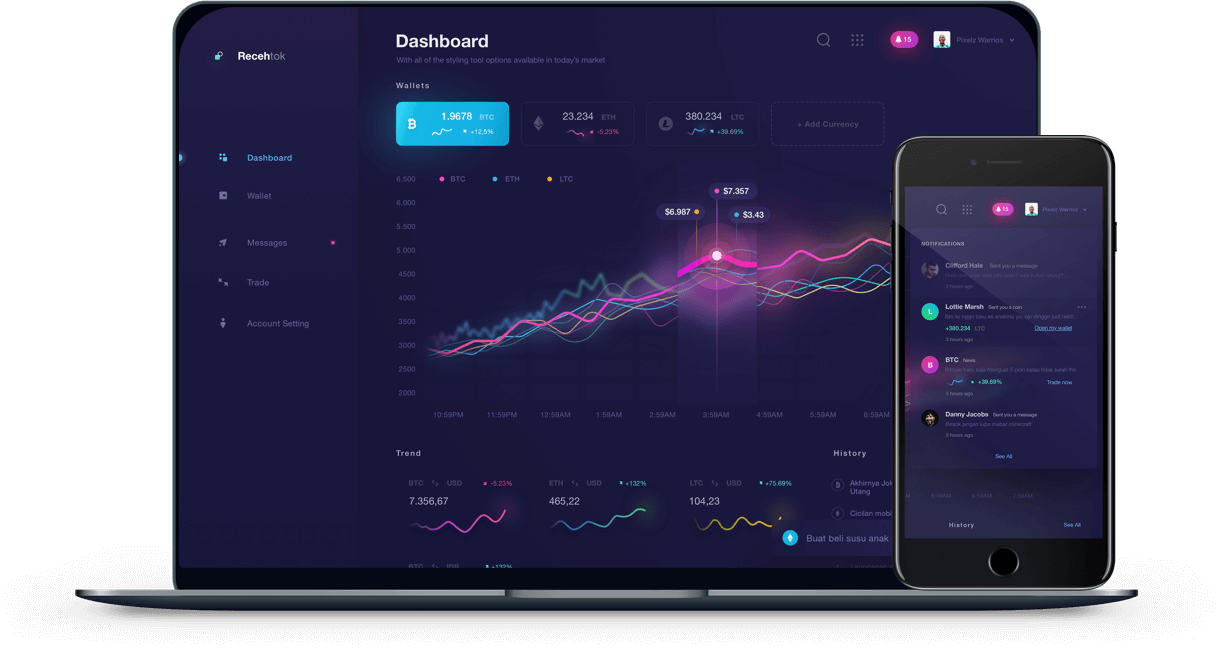

Modern financial services firms need powerful tools to efficiently manage their clients' investment accounts and ensure their clients can easily access their account information. We have developed a bespoke Client Management dashboard to power our business and we license this same technology for use by other firms.

Secure login and user management powered by Okta

Secure document templating and digital signatures powered by DocuSign

Automatic account statement generation

Automatic reporting and email distribution

Detailed account transaction activity

Detailed investment market activity

Multi-user account access (delegated access)

Modern web-based interface. Fully smartphone compatible

In-transit and at-rest AES-256 bit encryptionn

Administrative panel:

Client on-boarding

Client account transaction administration (withdrawals/deposits)

Client-specific agreement parameters (profit sharing, fees, statement periods, etc.)

Account manager porfolio panel:

Manage groups of client accounts

Portfolio performance analysis with charts and customizable reports

Client-relation tools such as automated email correspondence

White-Label ready

Themeable to fit firm-sepecific branding

Customizable feature-set to accomodate firm-specific workflows and business processes